4 Reasons to Expand Your Nonprofit’s Donation Options

The fundraising landscape is always evolving with new technologies, best practices, and trends. To stay ahead of the curve, it’s vital that your organization keeps up with and remains open to new fundraising possibilities. In this article, we’ll explore one easy way you can do so: expanding your donation options.

From cryptocurrencies to donor-advised funds (DAFs) to in-kind gifts, there are plenty of other ways to give to nonprofits besides donating cash. However, organizations must intentionally accept and promote different types of donations to benefit from these methods.

Let’s explore four compelling reasons you should expand the options on your giving page and tips for doing so effectively.

1. Engage more donors.

According to Double the Donation, providing donors with more ways to give is the number one strategy for engaging and retaining them. Not all donors want to support your nonprofit in the same ways. By giving them opportunities to give in the ways that are most convenient and beneficial for them, you’ll appeal to a wider base of supporters and show donors that you value their different preferences.

Plus, some donation options come with additional benefits that help you engage donors:

- Recurring or monthly giving lets donors give automatically without having to fill out your donation form each time.

- Legacy giving options allow them to make a lasting, public impact on your organization.

- Matching gifts enable donors to double their donations and impact on your nonprofit at no extra cost to them.

- Non-cash donation methods like stocks, DAFs, and cryptocurrency offer donors extra tax benefits.

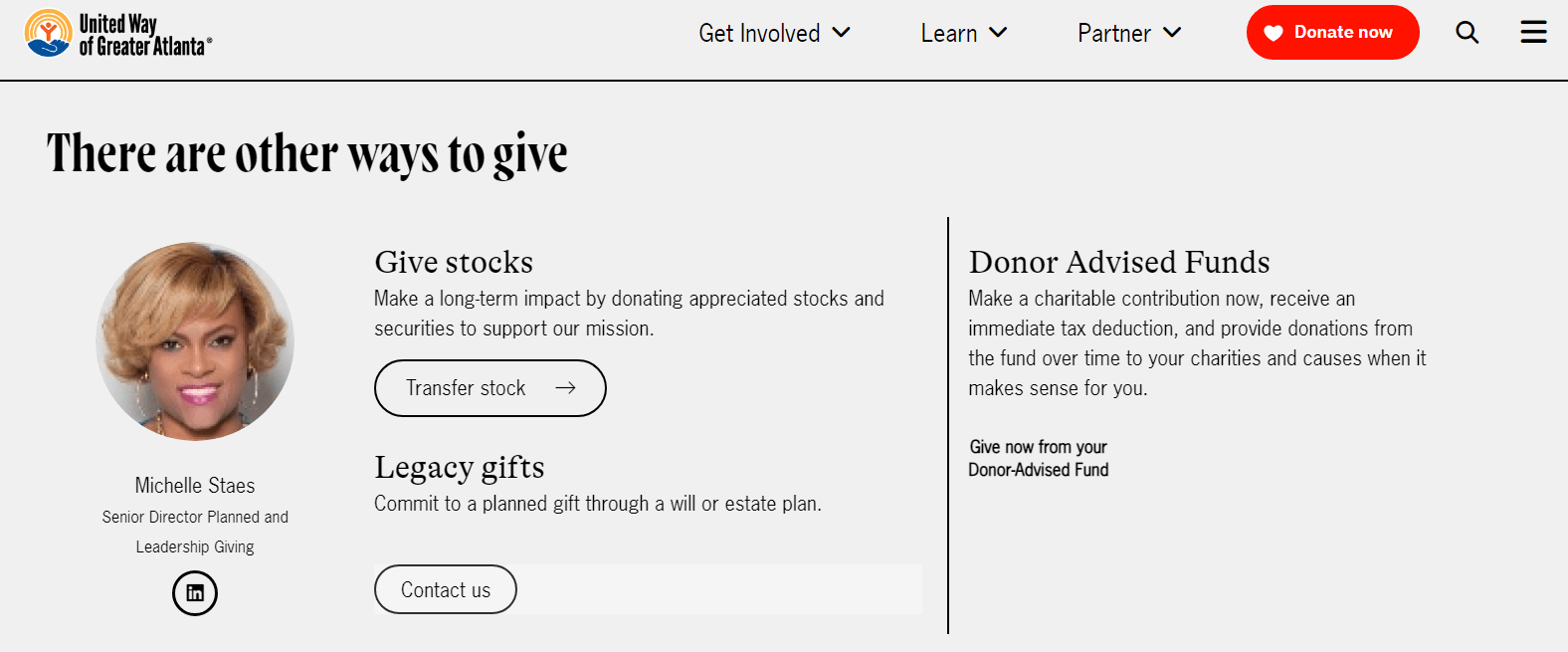

Highlight each of these benefits to your donors to draw attention to your new giving methods and encourage them to learn more. For inspiration, take a look at how the United Way of Greater Atlanta does so directly on its donation page:

To engage donors further, note individual donors’ giving preferences in your CRM as you discover them. If a prospect shows interest in crypto giving, for instance, add a note to their donor profile or put them in a segment of potential crypto donors. Having these preferences on hand helps you improve future asks and outreach by tailoring them to each donor’s unique preferences.

2. Keep up with the latest technology.

Expanding your donation options also incentivizes your nonprofit to tap into the latest and greatest in fundraising technology. From innovative matching gift tools to intuitive DAF grant widgets, there are plenty of exciting technological developments happening that your nonprofit can benefit from.

Cryptocurrency, in particular, is a newer technology that continues to create buzz both inside and outside the nonprofit sector. Since an estimated 21% of American adults have owned cryptocurrency by this point, it’s a worthwhile market for nonprofits to tap into. You can dive into this exciting technology development by taking the following steps:

- Leverage a crypto donation platform that enables you to accept crypto gifts from your donation page and automatically convert them to cash.

- Promote the option to donors who are likely to be interested, which might include high-capacity donors, Millennials, and more.

- Explain the tax benefits that donors receive by donating crypto, such as not having to pay capital gains tax on the crypto’s appreciation.

Be sure to thank your cryptocurrency donors in a variety of personalized ways to show them how much you appreciate their support and encourage them to give crypto again in the future.

3. Enhance your nonprofit’s reputation.

Donors and potential supporters want to know that your organization is capable of adapting and will be able to stand the test of time. By embracing newer technologies and donation options, you can solidify your reputation as a forward-thinking nonprofit that isn’t afraid of change.

Once you’ve added giving options like stocks and cryptocurrency, design a promotional strategy to get the word out and start enhancing your reputation. Leverage automation software like Marketing Cloud to develop and schedule automated email marketing campaigns about your new giving opportunities.

For instance, you might create an email series that highlights all the ways your nonprofit is embracing the future. Along with emails that explain your new cryptocurrency donation option, you could share a blog post about your nonprofit’s approach to artificial intelligence (AI) and tell the story of how your scholarship program funded a first-generation college student’s healthcare technology research.

In addition to email campaigns, make sure to promote new giving options on social media, your blog, and your website’s “Ways to Give” page.

4. Diversify your finances.

Finally, adding more giving options helps diversify your nonprofit’s revenue streams and allows you to develop a more well-rounded approach to fundraising. But that’s not all—building the infrastructure to accept these new options can open the door for even more opportunities to diversify and steward your organization’s finances.

Take the example of stock donations. To accept stock gifts, your nonprofit first needs to open a brokerage account. Along with letting you earn stock donations, Infinite Giving’s guide to nonprofit brokerage accounts explains that this account allows you to:

- Access more FDIC coverage for your nonprofit’s funds. Typically, only $250,000 in a single nonprofit bank account is protected by government FDIC coverage. Brokerage accounts with sweep programs, however, can increase your coverage up to $5 million.

- Invest your nonprofit’s reserve funds. If you keep your organization’s reserve funds in a brokerage account, you can choose to invest them in low-risk strategies that give them the potential to grow.

- Manage your cash more effectively to attain long-term financial sustainability. To put your nonprofit in a more stable financial position, you need to manage and steward your funds after earning them. Brokerage accounts enable you to protect and grow your reserve funds so your nonprofit is prepared to weather any unexpected circumstances.

Stock gifts aren’t the only doorway to financial growth opportunities. Accepting DAF grants can help you develop relationships with committed donors that lead to planned gifts or endowments, while tapping into matching gifts can help you earn future sponsorships or volunteer grants from donors’ employers.

Ultimately, providing donors with more donation options gives your nonprofit opportunities to strengthen both its relationships and financial stability. In doing so, you’ll be able to devote more time and resources to what matters most—fulfilling your nonprofit’s mission.

With the rapid evolution of technology, Salesforce solutions are ever-changing and improving features. Contact our team for up-to-date information.