Part Two – Teamwork = Success in Accounting Subledger Set Up

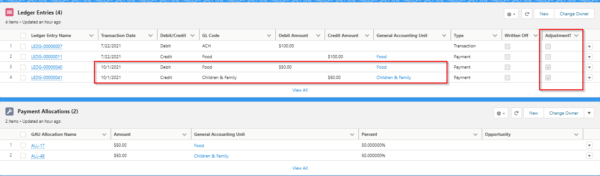

In our previous blog, we mentioned that future scheduled or written off Payments could be communicated to the Finance Team. Accounting Subledger also transforms the Opportunity, Payment and General Accounting Unit Allocation Salesforce data into Ledger Entries the Finance Department can use for importing into their system.

In our previous blog, we mentioned that future scheduled or written off Payments could be communicated to the Finance Team. Accounting Subledger also transforms the Opportunity, Payment and General Accounting Unit Allocation Salesforce data into Ledger Entries the Finance Department can use for importing into their system.

#1 – Accounting Subledger setup

Much like NPSP Settings, Accounting Subledger has a series of settings to review with your Finance Department and we recommend that you work closely with them through this process. Here are some examples of settings you will encounter in Accounting Subledger:

- Record types and filters provide the ability to control which Opportunities will create Ledger Entries. For example, you can exclude ‘In Kind Opportunities’ if the finance system doesn’t require this data.

- The Stage to Status mapping allows the nonprofit to control when Opportunities start to create the relevant Ledger Entries. Finance isn’t interested in a major gift being pursued, they only want to know when the donor commits the gift via writing.

- Group By Due Date and Allocation is an important setting that controls Ledger Entries based on whether your organization follows a cash or accrual strategy. For accounts receivable, finance can receive data split by both Allocation and due date vs. the default of Ledger Entries grouped by Allocation only.

- The Ledger Entry object has many informative fields already. Custom fields can be created and, using the Custom Fields Mapping feature (similar to Gift Entry Advanced Mapping), additional data can be populated on a Ledger Entry from an Opportunity, Payment or Allocation. For example, if you add the finance system’s general ledger code to a General Accounting Unit you can then map this to the Ledger Entry.

- Sync Opportunity and Payment Allocations is a game changer! Subledger provides Allocations at the Payment level as well as the Opportunity level. This setting keeps the data in sync.

- A list of default settings can be found here.

#2 – Test, test, and test again

Once Accounting Subledger is turned on, Ledger Entries will start to be created using the current settings. Ledger Entries cannot be deleted or edited after they are created, so it is important to make sure the correct settings are enabled before turning it on. Never enable Accounting Subledger without thoroughly testing in a sandbox first!

When testing in a sandbox, be sure to test all types of Opportunities and adjustments you might encounter. This could include:

- Adjusting an Opportunity amount

- Changing a GAU Allocation

- Modifying a Payment type

- Refunding a Payment

- Writing off a pledge Payment

- Changing the date of a scheduled Payment

As you create Opportunities and make adjustments in the sandbox, you can refresh the Ledger Entries by using the “Run Accounting Scheduled Job” button in the Accounting Settings. Each time you create an Opportunity or make an adjustment, you should see new Ledger Entries created after running the job, which you can review to ensure you have the correct settings enabled.

#3 – Hand off the data to finance

Your Ledger Entry data won’t do you any good if it just stays in Salesforce. Once you’ve confirmed your strategy for the creation of Ledger Entries in Salesforce, you will need to get the data out and into your finance system. With Accounting Subledger, gone are the days of manipulating your Opportunity data to get it in the correct format for your finance system. Your Ledger Entries should already be formatted correctly and ready for export or integration!

An integration can be ideal if you do not need to review your Ledger Entry data prior to importing it into your finance system. The integration can continually send the latest Ledger Entry data from Salesforce to your finance system without the need for manual intervention. Keep in mind, however, that integrations (via middleware or a custom solution) can require additional costs to set up and maintain over time.

Alternatively, finance data can be exported as a CSV file using a Salesforce report, and then uploaded to your finance system. This method gives you the ability to review your data before it gets uploaded, and can be a simpler solution to maintain. When using this method, be sure to only include the latest Ledger Entry data from Salesforce to avoid duplicate entries in your finance system using the Ledger Posting Status field.

#4 – Accounting Subledger is an evolving product

Salesforce released the Accounting Subledger product in the Spring of 2020. Since that time, each release has had wonderful new features and functionality added so it’s important to keep abreast of the updates happening with each new release.

Accounting Subledger comes in two versions. Review this Power of Us article for a version comparison and reach out to Redpath Consulting Group to learn more about how we can help you set up Accounting Subledger!

Connect with Redpath now!

With the rapid evolution of technology, Salesforce solutions are ever-changing and improving features. Contact our team for up-to-date information.